New York has very specific rules on what records a lawyer or law firm must maintain for an escrow or trust account. All lawyers, even those who are not directly responsible for their firm’s trust accounts, should be familiar with the requirements, which are strictly enforced. All lawyers or law firms holding client or third-party funds must maintain either an interest-bearing attorney trust account or an IOLA account (i.e., “interest on lawyer account”). Trust accounts are one of the most common areas where legal accounting mistakes are made. Whether you mismanage the accounts, put funds in the wrong account, accidentally use funds, or fail to report correctly, trust accounting errors are a big deal in accounting for law firms.

Drafting software, service & guidance

Compliance can be achieved by even the most mathematically-challenged lawyer, particularly with the help of readily-available computer software specifically designed for attorney trust accounts. Now is the perfect time to make sure that your firm’s accounts and https://www.bookstime.com/articles/suspense-account records fully comply with the rules. Later may be too late and it will certainly be more expensive and worrisome. A third choice for trust funds is a traditional interest-bearing escrow or trust account into which all trust funds are deposited by the law firm.

Benefits of using Clio Manage with QuickBooks Online

A hierarchical structure based on account types is crucial when creating a chart of accounts for a law firm. By categorizing accounts into assets, liabilities, revenue, and expenses, firms can generate accurate financial statements and reports efficiently. This structure enables easy identification and aggregation of data, providing a comprehensive overview of the firm’s financial health. For instance, calculating total assets or expenses becomes effortless by summing up the corresponding accounts within their types. A hierarchical structure streamlines financial management, enhances reporting accuracy, and empowers law firms with valuable insights for sound financial decision-making. The second cardinal rule is that lawyers may not deposit their own personal or business funds in their escrow or trust accounts.

- Nested under these you would find business credit card accounts, pooled trust accounts, and bank loans, among other things.

- The items are automatically added to a customer invoice at billing time.

- It is critical to check with the Bar Association in your state to see if they allow General Retainers.

- You also need to set up an Other Current Liability account to track the client’s costs and deposits.

- This structure enables the firm to generate accurate financial statements, including balance sheets, income statements, and cash flow statements, with ease and precision.

- It also integrates with MyCase legal case management software which makes managing firm finances easier with legal invoicing, time tracking, financial reporting, legal payment collection, and automated workflows.

Common legal accounting and bookkeeping mistakes

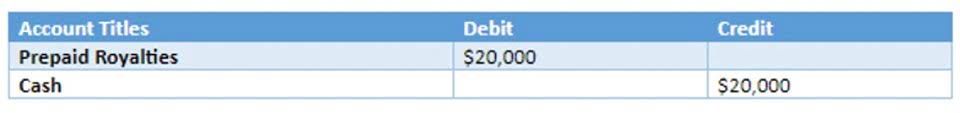

IOLTA accounts are designed to keep client funds separate from your typical business or operating account—where you are allowed to accrue interest. It’s also important to keep accurate records and track funds in general retainers. Unearned fees (like general retainers) should be kept in a separate account so that they are not used in error.

What is the Difference Between a Legal Assistant Vs. Paralegal?

You may need parts of your old files to check for conflicts of interest with former clients. Under DR 5-105(E), which was added to the Code of Professional Responsibility in 1996, a law firm must have a system in place to check for conflicts with current or prior engagements. Under DR 5-108(A), a lawyer must not oppose a former client in a “substantially related” matter without the former client’s informed consent.

If you are tracking income by a timekeeper, you may want to setup items for every timekeeper. Rates can be setup using Price Levels, Bill Rate Levels or a combination of both. You also need to set up an Other Current Liability account to track the client’s costs and deposits. Join lawyers from over 15,000 firms who trust MyCase to grow their firm while managing their caseload.

- First, as mentioned above, DR 9-102(D) requires you to keep certain bookkeeping records for seven years.

- It’s also important to keep accurate records and track funds in general retainers.

- A third choice for trust funds is a traditional interest-bearing escrow or trust account into which all trust funds are deposited by the law firm.

- QuickBooks software uses “Items” to assist you in the consistent use of the correct accounts when entering transactions.

- A well-organized Chart of Accounts is a vital tool for effective financial management in law firms.

- Trust accounts are one of the most common areas where legal accounting mistakes are made.

- In the dynamic legal landscape, law firms must adapt to changes in regulations, client needs, and industry trends.

The rules vary by state, but at a minimum, attorneys are required to maintain “complete records.” The American Bar Association publishes a list of recordkeeping requirements by state. By assigning specific codes and names to various accounts, a chart of accounts enables accurate tracking. It facilitates streamlined bookkeeping, simplifies tax preparation, and ensures compliance with regulatory requirements.

Legal bookkeepers and legal accountants work with your firm’s financials, with the shared goal of helping your firm financially grow and succeed. By doing this, your client’s records will clearly show what those funds are for in the IOLTA account. In deciding how long to keep closed files, there are three main considerations. First, as mentioned above, law firm chart of accounts DR 9-102(D) requires you to keep certain bookkeeping records for seven years. Second, in 1996 the statute of limitations for legal malpractice actions in New York was shortened to three years. Third, there is no statute of limitations at all for disciplinary charges in New York (though proposals for a statute of limitations are now circulating).